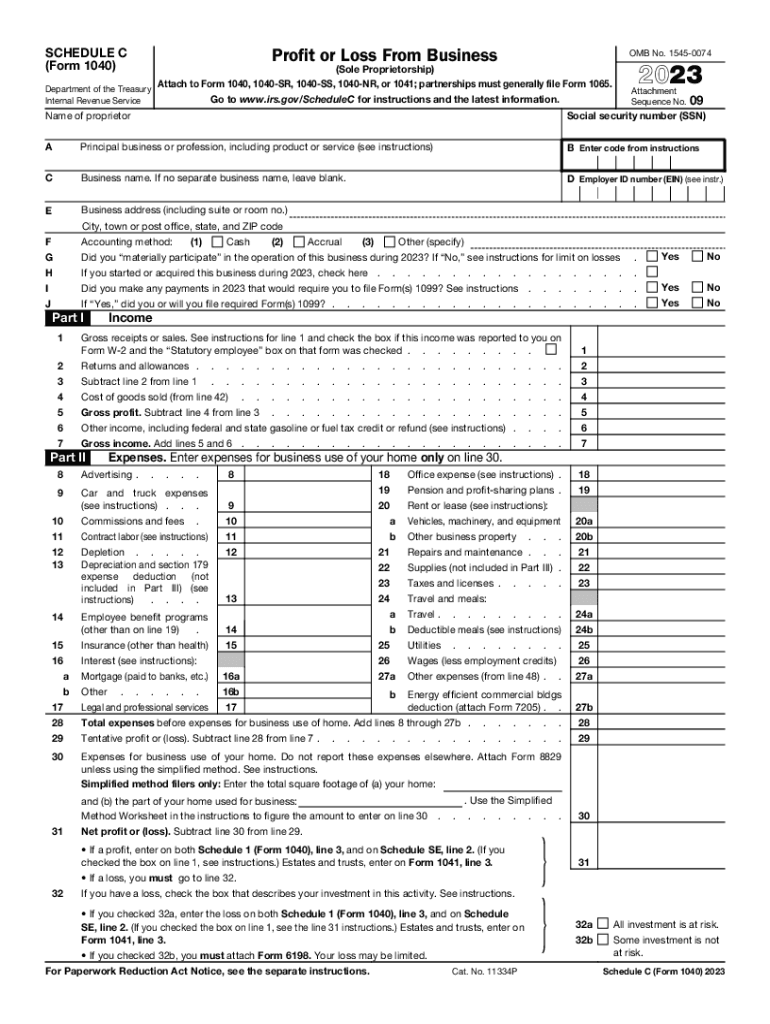

2024 Schedule C-Ez Instructions 1040 – Fill in your name, Social Security number and address on Schedule C or C-EZ. Identify the type of business you worked from the codes listed in the instructions back to your 1040, 1040A . Sole proprietors transfer any business losses shown on their Schedule C or Schedule C-EZ to their federal return Prepare Form 1040 to file your income taxes. Include any income you have .

2024 Schedule C-Ez Instructions 1040

Source : irs-schedule-c-ez.pdffiller.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2023 Instructions for Schedule C

Source : www.irs.gov1040 (2023) | Internal Revenue Service

Source : www.irs.govWhat Is Schedule D: Capital Gains and Losses?

Source : www.investopedia.com2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.comWhat is an IRS Schedule C Form?

Source : falconexpenses.comC1204 Form 1040 Schedule C Profit or Loss from Business (Page 1

Source : www.nelcosolutions.com2023 Instructions for Schedule F

Source : www.irs.govWhat is an IRS Schedule C Form?

Source : falconexpenses.com2024 Schedule C-Ez Instructions 1040 2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable : Much has already been written about the Flexibility Act, SBA Interim Rule changes, and EZ Forgiveness Application businesses that file a Schedule C to a Form 1040 of the owner or entities . Are there ways to reduce this tax burden? Here’s what you need to know. Schedule C (1040) is an IRS tax form for reporting business-related income and expenses. Its official name is Profit or Loss .

]]>

:max_bytes(150000):strip_icc()/2023ScheduleDForm1040-bce9771cbe94498ab34d6b9107e208de.png)